The Minterest Edge: Maximising Returns and Minimising Risk with Stablecoins

Crypto markets are inherently volatile, with daily pumps and dumps of over 10% – even across blue chip coins and tokens – commonplace.

This volatility and the associated risk have made stablecoins in DeFi increasingly important and attracted growing interest from retail and institutional investors.

However, as with any developing sector, problems arise, and industry leaders need to step up and offer practical solutions.

In this article, we explore the issues of retaining long-term capital in DeFi, the limitations of current stablecoin integrations, and how Minterest is taking advantage of the growing stablecoin market to benefit the $MINTY community.

Capital Retention Challenges in DeFi

Since its inception, the DeFi sector has faced significant challenges in attracting long-term investors and retaining their capital – especially during bear market phases.

These challenges became more pronounced through 2022 – 2023, as DeFi’s TVL decreased by 75%. While this was largely due to a string of adverse black swan events, such as the Terra crash and the bankruptcy of FTX and 3AC, many investors simply saw better opportunities outside DeFi. They moved their capital to more stable or risk-averse investments and said goodbye to the risks of DeFi.

The problem of rotating capital and a lack of sticky liquidity (investments that are held long-term) highlight the need for more safe and reliable DeFi investment options.

Although stablecoins are well-positioned to solve this issue by offering stability and predictability, their integration into existing DeFi platforms has limitations.

The Current Limitations of Stablecoins in DeFi

One key issue is in generating substantial returns. Many platforms offer lower yields on stablecoin deposits, making them less attractive for long-term investors.

Another challenge is the user experience in DeFi platforms. The complexity of products is often daunting – especially for newcomers. The technicalities involved in lending, borrowing, and yield farming with stablecoins require a steep learning curve, deterring potential users from fully engaging with these platforms.

Lastly, there’s a question of trust and security. The DeFi space has witnessed its share of security breaches and failed projects, shaking investor confidence. Users are increasingly seeking platforms that not only offer the stability of stablecoins but also provide advanced security measures and transparent operations.

These challenges create a gap in the market – a need for a platform that can maximise the potential of stablecoins while offering an accessible, secure, and high-yield environment for both seasoned investors and new entrants.

Minterest: Revolutionising DeFi with Stablecoins

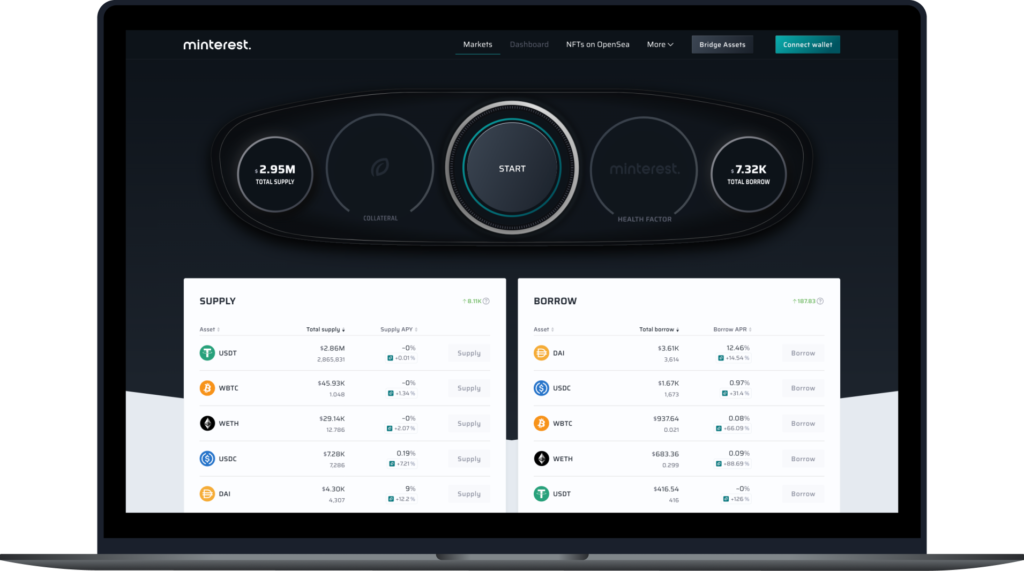

Minterest aims to be a game-changer in the lending and borrowing sector by redefining how stablecoins are used. It tackles the issues head-on, providing a platform that not only embraces the stability of stablecoins but also maximises their potential in a user-friendly environment.

Stablecoin Yield Gets Real

All lending positions on Minterest are met with additional yield in the form of $MINTY tokens – given as a reward for supplying liquidity to borrowers. Borrowers also receive $MINTY yield, which can help negate the costs associated with taking a borrowing position.

This attracts capital and retains it, providing an effective counter to the trend of mercenary capital, where investors move in and out for quick gains.

User-Friendly DeFi Experience

Understanding the complexities involved in DeFi, Minterest simplifies the experience. It offers a platform where new users can easily navigate stablecoin lending and borrowing across multiple blockchains and gauge the health of their position – all without the fear of unfair liquidations, thanks to the Solvency Engine.

Minterest’s user-centric UI and UX is key to attracting and retaining a broader user base, bridging the gap between traditional and decentralised finance.

Security and Trust

In an environment where trust is paramount, Minterest prioritises security and transparency.

Minterest has demonstrated a commitment to maintaining the highest security standards. The protocol has successfully completed seven audits to date by leading firms, including Trail of Bits, Hacken, and PeckShield.

With the most recent Zokyo audit scoring of 94/100 and a proactive stance on addressing findings, Minterest continues to solidify its position amongst the most reliable and trustworthy DeFi platforms.

Charting a Stable Future with Minterest

As the DeFi landscape evolves, the growing need for stable, low-risk assets like stablecoins is reshaping the lending and borrowing sector, offering a reliable alternative to the high volatility typically associated with cryptocurrencies.

By capitalising on this trend, Minterest is addressing the immediate needs of investors and setting a precedent for the future of DeFi.

Its high-yield offerings on stablecoin investments present a compelling case for retail and institutional investors, distinguishing the platform from competitor products offering significantly lower returns.

The platform’s approach goes beyond providing attractive yields; it’s about building a sustainable and stable DeFi ecosystem. By incentivising long-term engagement and providing a haven during market fluctuations, Minterest is playing a crucial role in retaining capital within the DeFi space. All this will be done while helping the $MINTY community gain access to high yields and a user-friendly and trustworthy lending and borrowing experience.

To learn more about what Minterest is building and how you can get involved, check out the roadmap, join the $MINTY community on Twitter, and drop by the Telegram or Discord channel for a chat!

14, December 2023