Crypto Borrowing 101

DeFi challenges the norms of traditional lending that banks have enforced for generations. This guide delves into the basics of crypto borrowing and the opportunities it opens for lenders and borrowers alike. By leveraging your crypto assets, you can unlock capital without selling your digital holdings.

In this article, we dive deeper into what crypto borrowing is, how it is different from traditional borrowing, and where to get started with borrowing on Minterest.

What is crypto borrowing?

Crypto borrowing is a DeFi feature that allows investors to take loans using their crypto assets as collateral. Collateral means using your crypto holdings as a security against your loan.

By being alternatives to traditional banks, decentralised platforms play the role of intermediaries in connecting borrowers with lenders directly. In crypto borrowing, transactions are governed by smart contracts. With their terms coded in, these self-executing contracts make every transaction transparent with all information recorded and easily verifiable on the blockchain. While such contracts don’t set the rules themselves, they enforce the predefined terms of borrowing and lending automatically.

Borrowers have access to a variety of loan options. Collateralised loans are the most common in the industry and require over-collateralisation to mitigate risk. This structure means you can borrow only a fraction of your collateral’s value. For those who prefer flexibility, crypto lines of credit offer more funds, with interest rates applied only to the amount you use. Another type, uncollateralised loans, depends on creditworthiness and trust, but they are rarely offered in crypto due to the high risks involved.

Benefits of crypto borrowing

Crypto borrowing offers numerous benefits and provides an efficient way to manage your finances. Here are the key advantages as opposed to TradFi loans:

- Access to liquidity: Borrowers can get cash by taking out a loan against their crypto. It allows them to keep their assets and any potential future increase in their value.

- Investment leverage: By using crypto as collateral, investors can access funds to diversify or increase their investment portfolio.

- Hedge against volatility: Crypto borrowing can help reduce the risks that come with market value changes.

- Efficiency and accessibility: The process avoids the credit checks and paperwork of traditional banking and offers a faster borrowing experience.

- Competitive rates: The interest rates for crypto borrowing are often more profitable compared to traditional banks.

Crypto borrowing on Minterest

Minterest is the first decentralised lending protocol that returns 100% of fees to its users. As opposed to lending protocols like Aave, Compound, and others, the protocol design is deflationary and benefits both lenders and borrowers. It’s engineered to attract and reward long-term liquidity providers and holders. The platform gives back the value it earns to users and those holding $MINTY tokens.

Borrowing

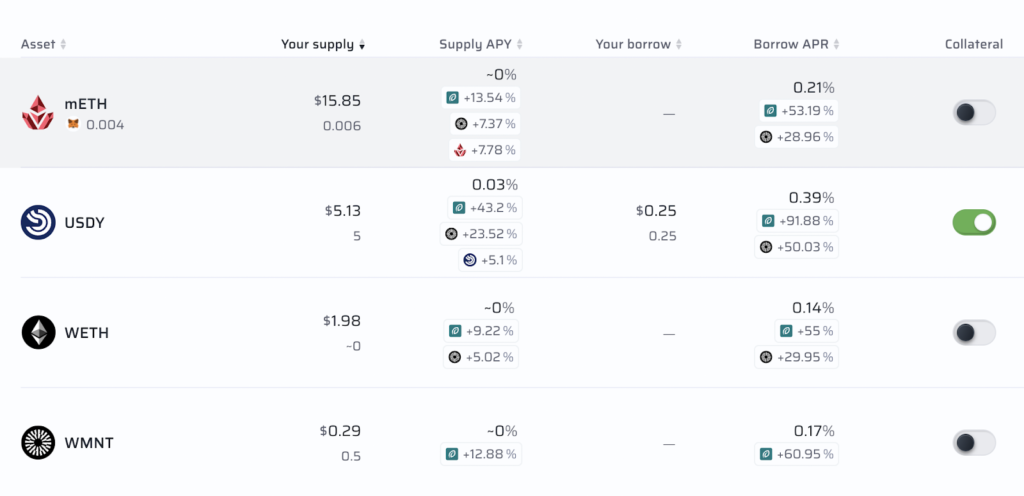

Borrowing on Minterest is flexible. The amount that can be borrowed depends on the value of assets you have supplied as collateral and the available liquidity in the protocol. If there isn’t enough liquidity or if your health factor drops below its threshold, you won’t be able to borrow. You can check the liquidity and borrowing parameters for each market on the market details page of the app.

Interest rates and $MINTY rewards

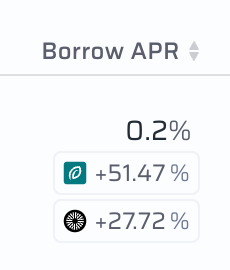

On Minterest, the interest rate for borrowing is dynamic and it adjusts based on the demand for the asset you want to borrow. You can always see the current rate right on your dashboard.

When you borrow on Minterest, you’ll be paying interest on what you borrow, but you’ll also be earning $MINTY rewards based on how much you’ve borrowed. Both the interest rates and $MINTY rewards change often, and you can find all the latest details, like APR and any rate changes, on the market details page in the app.

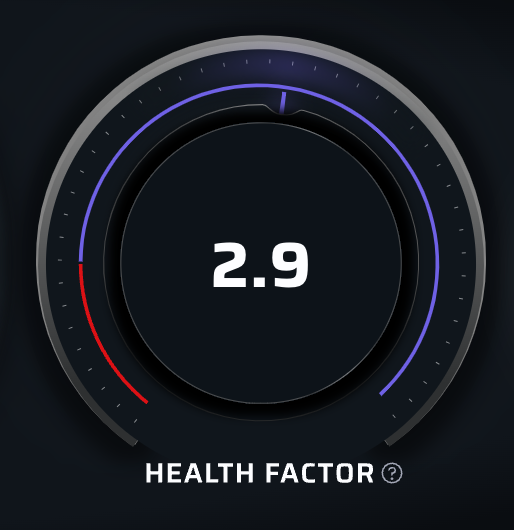

How to avoid liquidation

Keeping a good health factor well above “1” is key to avoid liquidation on Minterest. If it drops below “1” into the red zone, the protocol will use some of your collateral to pay off your loan. To prevent this, you can do two things: pay back a portion of your loan early, which is usually a preferable choice, or supply more collateral to improve your health factor.

Minterest offers a variety of tools and features to help you keep track of your loan, lower the chance of your collateral being used, and ensure your borrowing experience is safe and stable.

How to get started

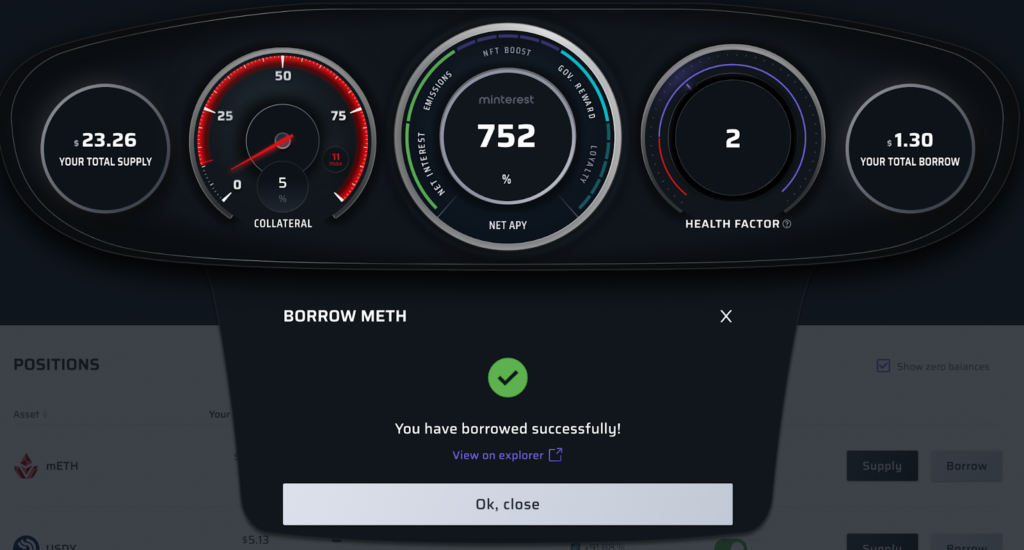

Getting started with Minterest borrowing is easy. To borrow an asset on Minterest, follow these steps:

- 1. Begin by supplying an asset to the platform, which will be used as collateral for your loan.

- 2. After supplying your asset, go to either the “Markets” or “Dashboard” page on Minterest.

- 3. Enable collateral for all token markets you want to borrow against.

- 4. Choose the “Borrow” button for the specific asset you wish to borrow.

- 5. Decide on the amount you want to borrow.

- 6. Finalise your borrowing decision by confirming the transaction.

- 7. Interest payments will automatically commence once your borrow is registered, based on that asset’s current borrowing interest rate.

Conclusion

Crypto borrowing on Minterest opens a new chapter in DeFi. Minterest unlocks the highest sustainable yields and best borrowing terms as the only DeFi lending protocol returning 100% of fees to its users.

Don’t miss out on the latest in DeFi and crypto borrowing: follow Minterest on Telegram, Discord and Twitter.

06, February 2024