From Aggregators to Omnichain Solutions — How Minterest is Bridging the Lending & Borrowing Gap

The ability to connect blockchains and help liquidity flow freely makes bridges and cross-chain solutions essential to DeFi. Over the past few years, the technology has evolved from basic bridging systems to sophisticated aggregators and omnichain protocols.

But with progress comes challenges. Several high-profile security breaches and hacks have underscored the sector’s vulnerabilities and emphasised the need for more secure and reliable solutions.

By integrating state-of-the-art cross-chain solutions, Minterest proactively addresses these challenges and aims to provide a safer and more efficient multi-chain lending and borrowing platform.

In this article, we’ll delve into the evolution of cross-chain technology, the hurdles it has faced, and how Minterest is leveraging the latest advancements to stay ahead in the DeFi curve.

Bridging Vulnerabilities

Bridges serve as connectors between blockchains designed to facilitate the transfer of assets from one network to another. For example:

A user wants to move assets from Ethereum to BNB Chain. They lock their $ETH on the Ethereum network, and the bridge mints an equivalent amount of $ETH on the BNB Chain. This $ETH can then be used within the BNB Chain ecosystem.

Early iterations relied on simple mechanisms: lock assets on one chain and mint the equivalent value on a target chain using smart contracts. While technically effective, some of these designs lacked advanced security features, making them susceptible to hacks.

One of the most notable bridge hacks in recent history was Axie Infinity’s Ronin Bridge, which was breached in March 2022. The attacker gained majority control of the validator nodes, stealing over 173,600 $ETH and 25.5 million $USDC—a combined value at the time of over $650 million.

Modern Bridging: Enhanced Security and Efficiency

As the DeFi ecosystem has matured, the need for more secure and efficient bridging solutions has become increasingly evident. The latest generation of bridges and cross-chain solutions incorporate advanced features, distinguishing them from their predecessors:

- Cryptographically Signed Messages: Modern bridges use signed messages to instruct smart contracts on the destination chain.

- Multi-Sig Wallets: Multi-sig wallets sign off on deposits and withdrawals during bridging.

- Rollups: Solutions that bundle sidechain transactions into a single transaction and generate a cryptographic proof verified on the mainchain.

- Decentralized Relayers: A network of relayers, backed by collateral, ensures accurate cross-chain information transfer.

- Cryptographic Proofs: Techniques like zk-SNARKs and rollups validate transactions.

- Interoperability Protocols: Layer-0 protocols, like Polkadot’s relay chains, facilitate communication between different blockchains.

Introducing these technologies and many more marks a significant step forward in DeFi, ensuring safer and more reliable cross-chain interactions.

Bridge Aggregators: Introducing Swing

As the DeFi sector grows, navigating new technologies can challenge everyday users.

Bridge aggregator Swing offers a unified interface to simplify this, scanning multiple bridges to find the best routes based on fees, speed, and liquidity.

Swing’s Benefits:

- Aggregation: Aggregates 60+ bridges and DEXs for optimal cross-chain transactions.

- Efficiency: Eliminates manual bridge searches, automatically finding the best path.

- User Experience: Intuitive interface for quick fee and transaction time comparisons.

- Security: Integrates only with trusted and audited bridges.

Swing aims to address the complexities of navigating multiple bridges by providing a more streamlined user experience.

LayerZero: Advancing Cross-Chain Communication

Beyond bridge aggregators, omnichain protocols like LayerZero offer a deeper level of integration with multiple blockchains, serving as a universal connector.

LayerZero Highlights:

- Omnichain Design: Connects with any blockchain, ensuring versatility and long-lasting utility as different blockchains emerge.

- Efficiency: Users can bypass traditional bridges, reducing fees and transaction times.

This approach allows for direct cross-chain interactions, sidestepping the need for several intermediaries.

Minterest’s Swing Integration

As Minterest continues to innovate, it’s integrating leading cross-chain protocols—Swing and LayerZero—to enhance its multi-chain lending and borrowing capabilities.

Minterest’s collaboration with Swing aims to streamline the user experience, eliminating the need for multiple intermediaries and allowing users to transfer assets between chains—all with the click of a button on the Minterest platform!

Let’s look at how the integration works and its benefits to LPs and borrowers.

Traditional Approach:

A user holding $USDC on Polygon wants to capitalise on a high-yield opportunity on Minterest’s Ethereum platform. Typically, they’d undergo multiple steps on an external platform to bridge their $USDC, involving several transactions and intermediaries.

With Minterest & Swing:

Disclaimer: The following is a hypothetical example for illustrative purposes only. Minterest does not have immediate plans to deploy on Polygon.

- 1. User with $USDC on Polygon sees a lending opportunity on Minterest’s Ethereum.

- 2. They open the Swing modal for bridging.

- 3. The modal detects the $USDC on Polygon.

- 4. With a few clicks, Swing bridges the $USDC to Ethereum.

- 5. The user can now lend the $USDC on Ethereum.

Thanks to Swing, users enjoy a more streamlined lending and borrowing experience and can quickly capitalise on cross-chain opportunities with reduced steps and costs.

Minterest’s integration with LayerZero’s omnichain protocol offers a direct connection to multiple blockchains. This enables users to tap into opportunities on various chains without the need to move or convert assets. Essentially, users can earn yields on assets in their native form, sidestepping additional costs like bridge and swap fees.

Let’s take a look at an example scenario:

Disclaimer: The following is a hypothetical example for illustrative purposes only. Minterest does not have immediate plans to deploy on Arbitrum.

A DeFi user wants to earn yield on Arbitrum but is holding $WBTC on Ethereum.

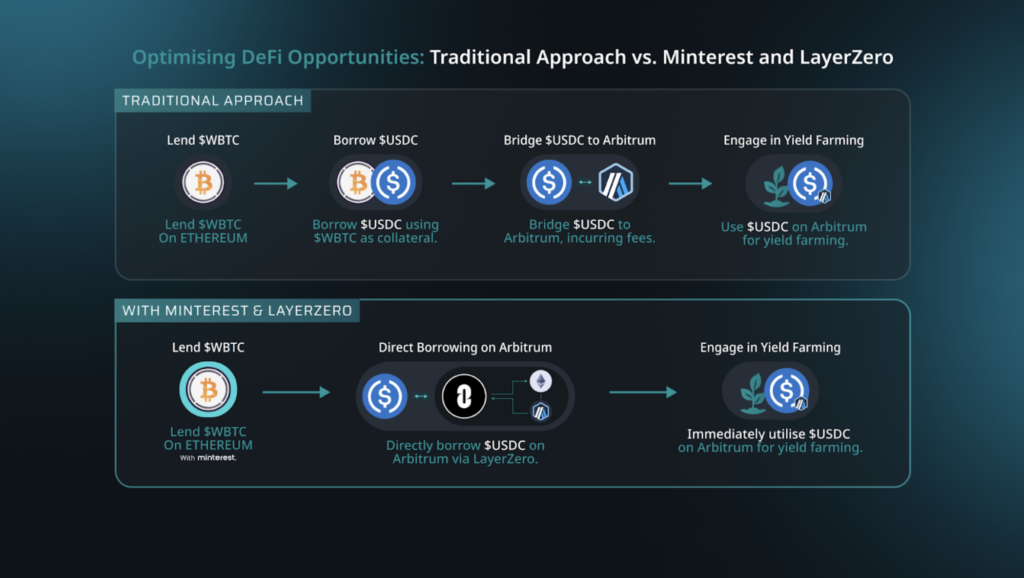

Traditional Approach:

- 1. Lend $WBTC on an Ethereum protocol to earn interest.

- 2. Borrow $USDC against the $WBTC collateral.

- 3. Transfer $USDC to Arbitrum using a bridge, incurring fees.

- 4. Start yield farming with $USDC on Arbitrum.

With Minterest and LayerZero:

This will be available in Phase 3 of Minterest’s Roadmap

- 1. Lend $WBTC on Minterest’s Ethereum platform.

- 2. Directly borrow $USDC on Arbitrum via LayerZero, eliminating the bridge step.

- 3. Begin yield farming with $USDC on Arbitrum.

By integrating LayerZero, Minterest allows users to skip the bridging phase, saving on fees and time. This efficient method lets them swiftly tap into cross-chain yield farming opportunities.

Wrapping Up

Cross-chain solutions have evolved from early direct connections with security issues to today’s sophisticated bridges, aggregators, and omnichain protocols.

Minterest’s Multi-Chain Strategy incorporates the advanced technology behind Swing and LayerZero to welcome a new era of multi-chain lending and borrowing.

With Swing, users benefit from a unified interface that aggregates multiple bridges, simplifying cross-chain transfers and ensuring optimal routes for transactions.

LayerZero’s omnichain protocol further streamlines multi-chain lending and borrowing, eliminating the hassles of intricate bridging processes.

Together, these integrations allow users to effortlessly move assets across chains, reducing costs and broadening DeFi opportunities.

For a deeper dive into Minterest’s partnerships, upcoming developments, and Multi-Chain Strategy set to roll out in three stages over the upcoming year, explore the recent articles. Engage with the $MINTY community by following Minterest on Twitter, and don’t hesitate to join the conversation on Telegram or Discord!

02, November 2023