Minterest Roadmap: What’s Next

Updated on April 2, 2024. Changes logged at end of article.

Minterest’s mission is to be the leading decentralised money market in Web3. Its design is intended to offer competitive long-term yields to liquidity suppliers at attractive borrowing costs for borrowers.

To achieve the mission, there are two key objectives required:

- TVL: Offering liquidity suppliers the most robust and liquid money market.

- Accessibility: Providing seamless and barrier-free access to all users irrespective of the intermediary application or blockchain.

This article explores the near future for Minterest’s go-to-market roadmap, detailing the key upcoming phases that begin the march towards achieving Minterest’s mission. If you have not read the prior post that provides a baseline for Minterest’s current state, we would recommend you read it first here.

As a preface, the Minterest protocol has been operating without issue in a closed beta format (i.e., Private Launch) since early 2023. All subsequent development will build upon the underlying smart contracts, so that Minterest LP’s do not need to change their behaviour in any way.

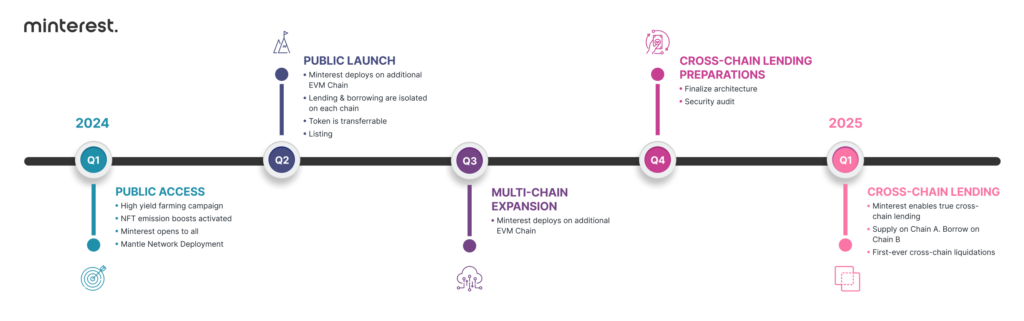

1. Roadmap

1.1 Public Access: Q1 2024

Public Access opens the protocol to anyone with a supported Web3 wallet on Ethereum and Mantle Network.

Included with Public Access:

- High rewards: Planned increase in emissions and staking rewards.

- NFT Boost Starts: Rewards on emissions increase up to 50% via Minterest NFT.

- Solvency engine launches: Borrowing allowances are expected to increase to match industry LTV ratios of 70%-90%. Learn more about why the Minterest solvency engine matters here.

- Governance token: Non-transferable during this phase.

1.2 Phase 1: Public Launch: Q2 2024

Public Launch builds on Public Access and unlocks vested governance tokens, allowing them to be transferable.

Included with Public Launch:

- Governance token: Transferable.

- Listing: Key integrations and listings.

1.3 Phase 2: Multi-Chain Expansion: Q2-Q4 2024

Minterest’s movement towards true cross-chain lending includes new chain deployments of Minterest across additional L1s and L2s in a controlled manner.

Included with Multi-Chain Expansion:

- Updated Minterest App UI to manage multi-chain access

- Common token markets such as certain stable coins (i.e. USDC) and/or volatiles (i.e. ETH) alongside unique token markets specific to the chain

- Minterest NFT deployments

1.4 Phase 3: Cross-Chain Lending: Q1 2025

- Minterest’s cross-chain architecture is planned to go live, allowing users to lend on one chain and borrow on another. Minterest’s solvency engine expands to support cross-chain liquidations.

Once the dates are finalised, further information will be provided.

Marching Forward Together

There is a lot to digest with the roadmap. And yet, there is still so much more to share, detailing out each phase, new and updated product features, community activities, and exciting campaigns planned – all coming to the blog in the weeks ahead.

Join us in the Minterest community channels on Telegram and Discord to participate in the conversation as we work together to shape the future of decentralised finance.

The Minterest team has addressed community questions related to the roadmap on the Minterest Gitbook under section Community Asks.

Edit: The Minterest team has addressed community questions related to the roadmap on the Minterest Gitbook under section Community Asks.

Edit: Nov 7, 2023 – Roadmap has been updated based on the latest announcements which positions Private Access and Public Access right ahead of Public Launch in Q1 2024 and includes the broader multi-chain strategy roll-out.

Edit: Feb 25, 2024 – Roadmap has been updated removing Private Access as per the latest announcements and developments.

Edit: April 2, 2024 – Roadmap updates to public launch timeline and additional deliverables through Q1 2025.

Road-map phases, timelines, reward levels, borrowing parameters, and all token-related features are subject to on-chain governance, technical audits, and market conditions; they may be modified, delayed, or suspended without notice. Figures and projections are illustrative only, results are not guaranteed, and nothing herein constitutes financial or investment advice.

07, August 2023