What Works (And What Doesn’t) In DeFi: How current DeFi protocols generate value

No one survived the crypto downturn unscathed. Noted CEXs failed, major NFT projects lost most of their value, and DeFi protocols collapsed.

Compound and Aave, in contrast, remain strong.

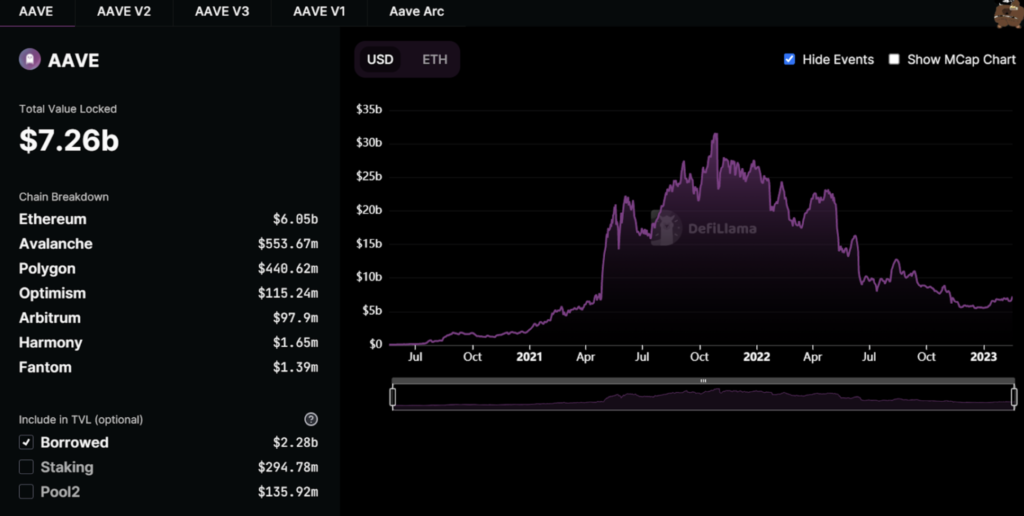

The two DeFi lending protocols have carved out a position as industry leaders, with $2.8 billion and $7 billion in TVL respectively. Together, they stand at the head of a DeFi sector poised for a potential rebound.

If Compound and Aave represent the best of DeFi 1.0, what comes next? What are they doing right? And what will DeFi 2.0 do better?

In an ongoing series on the current state of DeFi (see part 1 here), this article describes how leading DeFi protocols are currently structured, and how Minterest and DeFi 2.0 aim to improve.

- DeFi Lending Protocols – Basic Structure

- DeFi 1.0 Value Creation

- DeFi’s True Value: Wealth-Building from Tokenized Assets

- Yield Farming Transitions to Real Yield

DeFi Lending Protocols – Basic Structure

Compound and Aave both rely on similar principles. Users of each protocol fall into two general categories: liquidity users (borrowers) and liquidity providers (lenders). Aave and Compound create asset pools for various crypto tokens, and users add to and withdraw from those pools.

The premise is straightforward. All borrowing is collateralised, meaning no user can take out more than they have put in. The actual practice gets a bit more complicated; since users rarely lend one token and borrow the same token, protocols rely on token pairs, with asset pools for each pair.

DeFi 1.0 Value Creation

Why use a DeFi lending protocol?

Access and inclusivity.

DeFi lending, as opposed to lending in traditional finance, reduces the friction of participation to anyone with a wallet, and provides absolute transparency to the inner workings of the protocol.

Permissionless – Anyone can participate. DeFi users don’t need to pass extensive financial scrutiny to participate. With sufficient collateral, whether it is Minterest, Aave, or Compound, users can simply connect a wallet and begin staking or borrowing.

Trustlessness – No one entity controls a user’s finances in DeFi. There is no loan approval and no extra hoops to jump through when supplying or withdrawing funds. Note that “trustlessness” does not mean “poor security.” For example, Compound touts “institutional” levels of reliability and safety. For its part, Minterest has undergone four security audits to date.

Liquidity

DeFi lending protocol participants gain access to liquidity, opening up a variety of use cases for both individuals and other ecosystem protocols. Borrowers utilize liquidity for several reasons.

Arbitrage. Arbitrage opportunities are aplenty across the market. The price of one asset may be higher or lower across different DEXs. A flashloan would allow a user to borrow that asset, swap the asset on the DEXs, make a tidy profit, and then pay back the loan all in one transaction.

Trading Positions. Borrowing assets to gain exposure to an asset forlonging or shorting it is a widespread use case. For example, if a trader believes the price of BTC will drop, they can lend a stablecoin, borrow BTC, sell BTC at spot price, wait for the price to drop, purchase BTC again, pay back the loan, and pocket the difference.

Short-Term Loans. Purchasing real-world goods and services without selling the original assets is commonplace for groups, like Bitcoin miners. Bitcoin miners fund the expansion of their operations by using their BTC portfolio as collateral to borrow stablecoins to purchase new mining equipment. Why?

- Miners maintain exposure to the underlying asset

- Miners do not trigger taxable events for selling the underlying asset (depending on the jurisdiction, of course)

DeFi’s True Value: Wealth-Building from Tokenized Assets

All of the above benefits get to the beating heart of DeFi: providing advanced wealth-building tools for users.

In DeFi 1.0, this took the form of yield farming. Demand for certain assets meant lenders on DeFi protocols could expect significant returns on their positions; rates of 20% APY were remarkable compared to TradFi savings interest rates of less than 1% but entirely unsustainable.

DeFi 1.0 quickly developed a yield farming problem. Investors earned sky-high returns built on the foundations of hyperinflationary tokenomics where tokens contained no underlying value. The unraveling of this flimsy structure came tumbling down during the crypto bear market, resulting in bank runs on protocols. Users withdrew and sold off their assets in droves as high-profile projects, like Terra, highlighted critical weaknesses in their designs.

Yield Farming Transitions to Real Yield

Despite high-profile failures, lending protocols functioned as they were designed to during the adverse market conditions, protecting lenders and borrowers where CeFi players did not due to their opaque walls and reliance on unwarranted trust from their users. In 2023, DeFi lending protocols are emerging as foundational layers for every major blockchain, as Aave and Compound have demonstrated.

Aave and Compound, with significant TVL, collect fees from activities (borrowing, lending, flash loans) on the protocol. Both protocols feature a governance token, providing some limited utility for repaying fees.

The question for DeFi remains how to develop dependably attractive yields (thus attracting greater TVL) without relying on an inflationary model.

So where does DeFi go from here, and how can Minterest improve the existing model?

Current DeFi Challenges

Dysfunctional governance tokens. Both Aave and Compound feature governance tokens. Both tokens convey voting rights for their respective protocol.

However, neither Aave nor Compound have made their tokens integral to the function of the protocol. The tokens do not derive any utility from the underlying lending and borrowing activities on these respective protocols, nor do the protocols derive value from the tokens outside of governance.

Predatory liquidations and outflow of fees. Protocol fees are generated from three areas: interest rate differential between lenders and borrowers, flash loans, and liquidations. Most of this value is parties who are not liquidity providers, even though the value is derived from them. Additionally, current DeFi lending protocols rely on third-party liquidators to remain solvent. Those liquidators are incentivized by collecting a portion of each loan liquidated, essentially a bounty for detecting under-collateralised positions on the protocol. And these liquidations siphon approx 50% of protocol value to themselves. What is clear is that there needs to be more alignment of incentives between liquidity providers and the protocols.

Future-Focused User Benefits

In both cases, DeFi 2.0 can build on the existing model to create additional value for users. Minterest is designed to do just this.

Minterest captures more fees. Minterest captures more fees than others because it handles liquidations through its innovative auto-liquidation engine*. Thus, Minterest can capture those fees unlike other protocols where this value is lost to third parties.

Minterest transfers all value back to users. Minterest captures all fee value and uses it to buy back its native token on-market through an automated Buyback engine. The token is then distributed back to users who participate proportionally in the protocol’s governance based on staking and voting in governance proposals.

MINTY is more than just a governance token. It’s a medium of value transfer, and the above benefits feed into the core function of the MINTY token. Minterest distributes the value it accrues from its various operations right back to the users of the protocol. The MINTY token is the medium by which this value is transferred back to participants, linking MINTY to the growth of the protocol’s TVL.. Such performance capabilities in a token are unique in the sector and form the bedrock of a new evolution of DeFi protocols.

Minterest provides Sustainable Real Yield. Minterest is designed to align the incentives of its core user, liquidity providers. Greater liquidity generates more significant fees, increasing the distribution of value back to these users. The results are fully sustainable yield farming for users and a DeFi revolution with the highest possible long-term APYs with the sector’s lowest borrow cost.

*Note that Minterest’s Autoliquidation Engine has been renamed to Solvency Engine.

17, February 2023