Intro: Minterest 101

Are you new to Minterest and want to get up to speed quickly? Maybe you learned about Minterest from a friend, or you are a recent participant in the Mantle Moonshot campaign and want to learn everything.

You’re in the right place! Here’s the TL;DR on what Minterest is, why it is different, and why you should care. But first, here is the quick and dirty, Minterest 101 X thread.

Please Note: Minterest is live on Mainnet Ethereum in a Private Launch phase and scheduled to be deployed on Mantle in January 2024.

What is Minterest

Minterest is a decentralized lending platform that aims to offer competitive, sustainable returns on their deposited assets while reducing exposure to predatory liquidations.

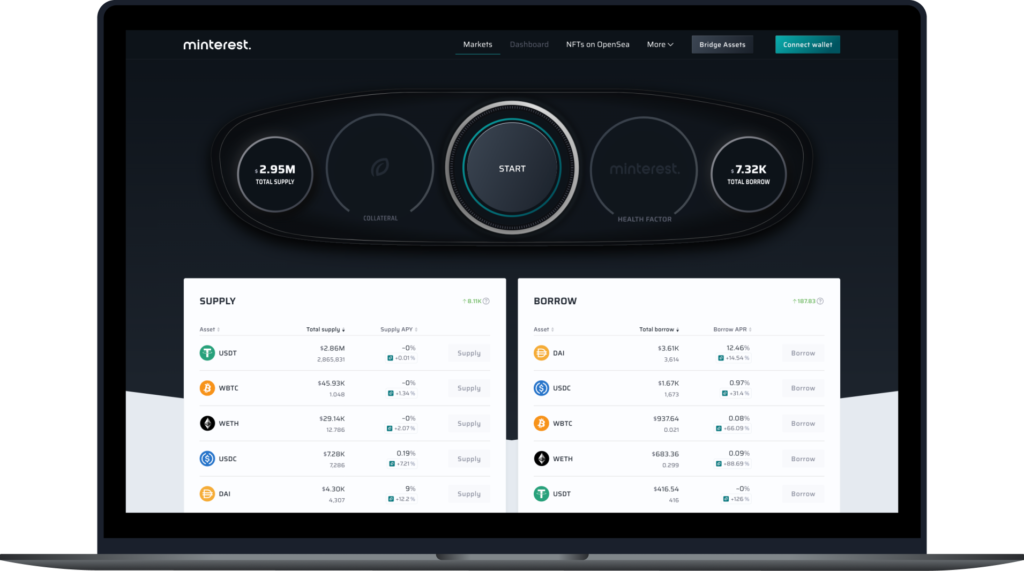

We’ll get into exactly what that means in a moment, but the first thing you should know about Minterest is what it will look like to be a user. Minterest has a user-friendly app dashboard that shows your current positions, position health, and what you’re earning on your assets. Borrowers and Lenders both have the same UI.

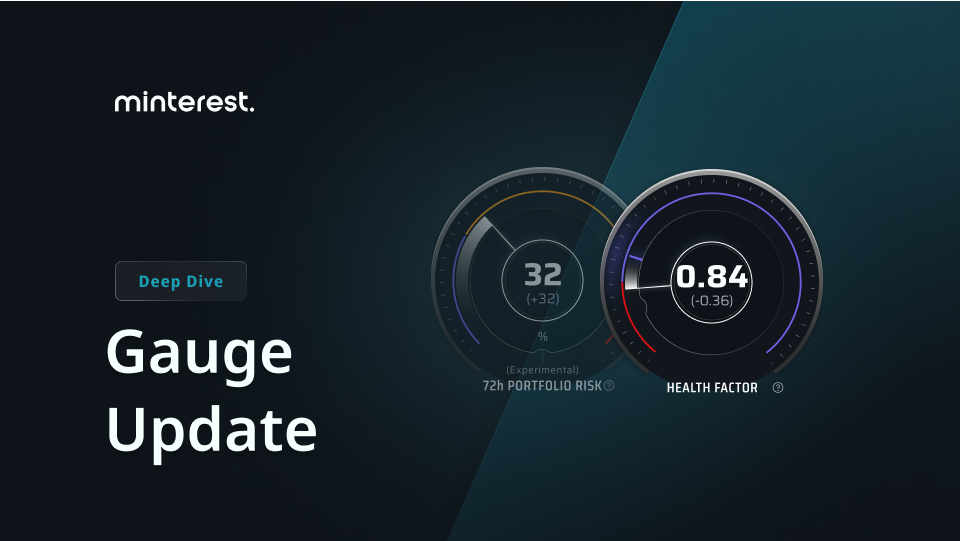

The next important topic for depositors or lenders is Minterest’s Health Gauge. Like others, this mechanism helps keep track of position and protocol solvency. The key difference lies in how Minterest handles insolvent positions.

Solvency Engine

The Solvency Engine is arguably the most important piece to the Minterest ecosystem. With the user’s interests at heart, the protocol can attract the liquidity it needs to succeed. Minterest’s solvency engine addresses this challenge. By creating and maintaining the solvency engine in-house, there is no need to incentivize third parties to liquidate a position. This is beneficial for two reasons:

- It is intended to mitigate the predatory aspect of liquidations: Liquidators profit from the distressed positions of borrowers and often take far more than is required to get these positions back into a healthy state. The Solvency Engine’s sole focus is rescuing positions, not profiting from them.

- Minterest is designed to redistribute fees collected back to the protocol users, aligning incentives directly with liquidity providers. The model is designed to route up to 100 % of net protocol fees* back to $MINTY ecosystem participants.

A Cross-Chain Future

Minterest plans to tap into the $25B of currently fragmented liquidity, offering users a deep pool of liquidity to borrow irrespective of the chain. Here’s how the cross-chain integrations with industry-leading builders LayerZero and Swing work. Our first non-Ethereum deployment will be on Mantle, a new optimistic Layer 2 that uses the first modular data availability solution.

Get ready for Mantle and Minterest to go live in January 2024!

MINTY Flywheel

Every protocol needs its kingmaker, and that’s the MINTY flywheel. With unique incentives around supplying and borrowing, Minterest incentivises users to stay on the platform, continue to collect their share of fees and build their stake, which invariably attracts new users. This is about building a self-sustaining ecosystem that allows Minterest to become a resilient liquidity train.

Security is Paramount

Security is one of our biggest concerns at Minterest hence we put the protocol through its paces through reputed and renowned auditors, including Trail of Bits, Peckshield, Hacken, and Zokyo. That’s seven audits in total as of November 2023!

Minterest NFTs

Minterest NFTs give (app.minterest.com) is currently operating in a private launch phase on mainnet Ethereum, allowing select whitelist and Minterest NFT participants access to supply and borrow.

Minterest NFTs can grant users bonus MINTY rewards; you can see the specific details for how the rewards work here.

But don’t let that stop you from looking around the app today and letting us know what you love AND what you would like to see improved. We’re going to be going LIVE on Mantle Network for their Moonshot campaign on January 4th, so get prepared by checking out the app today!

You can keep up to date with community activities, learn more about the protocol, and get questions answered in our Discord, Twitter, or documentation.

Have a #MINTYFRESH day!

Figures, timelines, fee‑routing percentages, yield boosts, and interest rates are illustrative based on current parameters and may change via on‑chain governance, audits, or market conditions; they may be modified, delayed, or suspended without notice. Borrowing involves collateral and liquidation risk—market movements can lead to loss of principal. Past performance is not predictive of future results. Nothing herein constitutes financial, investment, legal, or tax advice.

06, December 2023