Revealing Minterest’s Multi-Chain Strategy

As Minterest gears up for its public launch on the Ethereum mainnet in Q1 2024, our team is working diligently to ensure a smooth roll-out. With launch preparations underway, we are ready to reveal a larger strategic roadmap which has been brewing behind the scenes: Minterest’s multi-chain direction.

A New Blockchain Landscape

Between 2022 and 2023, there has been a remarkable surge in the number of Layer 1 and Layer 2 blockchains. With Vitalik, himself, championing an ecosystem of Layer 2s on Ethereum, the emergence of parallel operating L2s like Polygon 2.0 and Optimism, and the availability of rollups-as-a-service that can establish L2s in mere minutes – the blockchain landscape is rapidly changing.

Despite the ambition, these blockchains face a challenge: establishing dynamic ecosystems that draw both substantial user traction and high-value transactions. With most chains being general-purpose, integrating DeFi becomes essential. And, there is a growing demand for reliable lending protocols, with blockchain foundations eagerly scouting for teams and protocols that epitomise security and stability.

Liquidity Fragmentation: The Challenge

Liquidity remains a cornerstone for chains. Yet, over 50% of active liquidity is anchored on Ethereum, while the rest is spread across over 100 chains. This dispersion poses macro inefficiencies and systemic challenges, such as inconsistent token asset pricing across chains to the emergence of incompatible derivative tokens (i.e. multiple wrapped versions of USDT), further fragmenting liquidity.

As more chains emerge, this fragmentation is set to escalate, possibly hampering the expansion of Web3 liquidity. Addressing this issue becomes vital.

Minterest’s Roadmap to Unify Liquidity

We envisage a multi-chain future where diverse chains can seamlessly interact. Minterest is driven to engineer a landscape where chains have access to ample, compatible liquidity regardless of its origin. Liquidity will effectively act as a public good and significantly enhance macro-level market efficiency where chains can then focus on their unique offerings and treat access to liquidity as a given.

The aspiration is to expand Minterest’s architecture to ensure authentic cross-chain interoperability. This approach enables lending on one chain while borrowing on another, seamless liquidity migration, swapping of debt assets across chains, and holistic protocol health maintained via the Minterest Solvency Engine that expands to handle cross-chain liquidations among other features.

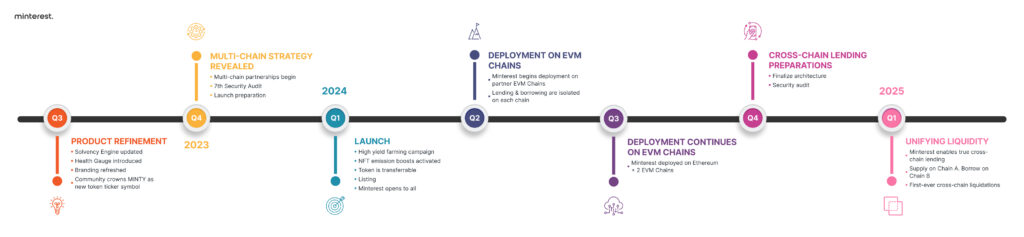

Minterest’s roadmap now expands into 2025 encompassing three distinct phases.

- Phase 1: Single Chain Deployment – Q1 2024

Minterest’s Public Launch on Ethereum.

- Phase 2: Mirrored Deployments – Q2-Q4 2024

Sequential deployments of Minterest across chosen blockchains. Here, lending and borrowing activities are chain-specific. $MINTY tokens and Minterest NFTs can move across supported Minterest deployments while retaining the same benefits as on the Ethereum deployment.

- Phase 3: Unifying Liquidity – Q4 2024/Q1 2025

Introducing genuine cross-chain lending and enhancing the solvency engine for cross-chain liquidations.

Each Minterest deployment seeks to unify liquidity, enabling partner chains to tap into an ever-growing liquidity network. The aim is to create a liquidity flywheel effect where liquidity attracts liquidity.

Stay tuned for additional details on Minterest’s cross-chain design, roadmap, and key partnership announcements.

Phase 1 Roadmap Revision

The comprehensive Minterest roadmap will be publicly updated to incorporate the multi-chain initiative. Additionally, after taking feedback from our community and partners into account we are adjusting the elements leading up to Public Launch to support the broader objectives for community growth and onboarding liquidity.

As communicated earlier, Public Launch and listing will occur at the same time and are scheduled for Q1 2024. We are actively working with listing partners to set a firm date. Upon confirmation, the Private Access campaigns will roll out five weeks ahead, succeeded by Public Access introductions three weeks before the grand launch.

Why the campaign dates are being adjusted is related to a number of recent engagements with liquidity providers. Many have shifted to a monthly P&L framework necessitating meticulous capital allocation plans that prefer a liquid $MINTY token. Streamlining the Private/Public Access campaign duration will now align closely to a firm Public Launch date. This phased approach is strategic, enabling Minterest to leverage $MINTY emissions to amplify rewards and onboard TVL rapidly.

$MINTY Fresh Community Campaign Teaser

We acknowledge that many in the Minterest community cannot contribute liquidity to Minterest due to the cost prohibitive nature of Ethereum so our team has been ideating solutions to reward proactive members in the run-up to the Public Launch.

In November, we’re launching an incentivised community campaign: $MINTY Fresh. This campaign will promote community growth, engagement, and education of Minterest. Exciting rewards, including a generous pool of $MINTY and potential NFT drops, await. More details to come shortly!

Closing Off

We are proud to finally share the future multi-chain vision of Minterest. Be on the lookout for a number of related announcements over the next several weeks that provide greater context and clarity.

The Minterest team is operating with best laid plans for the success of the Minterest protocol and testing it methodically at every quarter. Some adjustments along the way are to be expected, but we will continue to progress forward with the intention of fulfilling Minterest’s mission to be the leading decentralised money market in Web3.

16, October 2023