Minterest’s Health Gauge: Prioritising Portfolio Safety

Central to Minterest’s operations is growing and maintaining the Total Value Locked (TVL) on the protocol where there is a critical necessity to ensure the safety of user portfolio positions. In this piece, we will conduct a comprehensive exploration of the Minterest Health Gauge and its application in measuring and supporting loan health.

Understanding Loan Dynamics within Minterest

Minterest operates by facilitating over-collateralised loans. This essentially implies that every loan is supported by collateral with a value surpassing the loan amount. Illustratively, if Bob procures a loan of $50 USDT, he is obligated to collateralize it with assets worth considerably more – let’s say with Bitcoin worth at least $65 USDT.

Due to the inherent volatility of the crypto markets, the relative value of a loan’s collateral can oscillate. If this value diminishes below a predetermined threshold, the loan is liable for partial or full liquidation. To contextualise, should the value of Bob’s Bitcoin collateral reduce below $65, Minterest would instigate a liquidation process to settle the loan.

Deciphering the ‘Health Gauge’

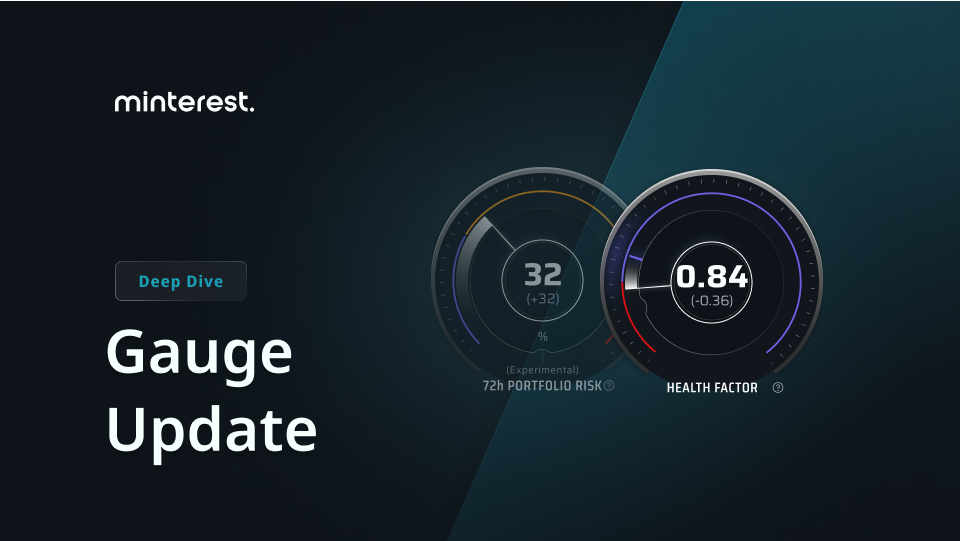

Situated on the user dashboard, the Health Gauge serves as an instrument for users to monitor their loan positions.

This mechanism presents a numeric value termed the “Health Factor”. A value exceeding “1” denotes stability, whereas a figure below “1” represents an insolvent position that is open for liquidation by Minterest’s Solvency Engine.

Computational Framework for Portfolio Health

Minterest’s architecture is distinct in its allowance for a basket of token assets to be used collectively to back loan positions. This structure aids users in diversifying their exposure across a wider set of collaterals to mitigate risk. However, it concurrently introduces a nuanced layer of computational complexity.

In Minterest’s holistic approach, liquidity is aggregated as the user marks which supply positions can be used as collateral. From there Minterest calculates the maximum allowable loan available to the user.

For illustrative clarity, if Alice commits 10 USD each to DAI, USDT, and USDC markets and designates DAI and USDT for use as collateral, her total collateral valuation is 20 USD.

The maximum amount of her loan borrow position is defined by the “Utilisation Limits” of each market. Let’s say that USDT has an 80% limit and DAI a 70% limit. The maximum permissible loan available for Alice is computed as:

10 USD * 80% (USDT) + 10 USD * 70% (DAI) = 15 USD

This computation underscores that Alice maintains a stable position with a collateral value of 20 USD, provided her loan remains within the 0 to 15 USD bracket.

To come back full-circle with this example, assume Alice decides to borrow 7 USDT. The ratio between this and the value of her total collateral is her position’s Health Factor:

15 USD / 7 USD (USDT) = 2.14

Since Alice’s Health Factor is above 1, she is currently safe from a liquidation event.

Advancing Portfolio Risk Management

Beyond the Health Gauge, Minterest has been developing AI-imbued mathematical models for an advanced risk engine. This model draws from year-spanning data sets and evaluates real-time price fluctuations to estimate potential liquidation events. A key challenge highlighted during our focus group studies is that while predictive models do offer valuable insights, they don’t always translate to direct, actionable steps for liquidity providers.

To address this, Minterest’s team is developing a broader set of risk management tools to facilitate informed portfolio management decisions. These enhancements include risk alerts based on key metrics, allowing for automating select actions such as repayments, and superimposing a user’s loan position atop chart data of aggregated historical liquidation “heat zones” among other features which will be included in the 2024 roadmap.

Minterest’s primary aim is to equip users with accurate, timely data to support informed portfolio decisions. With tools like the Health Gauge and the forthcoming refined risk assessment tools, Minterest remains committed to meeting the practical needs of its user base.

03, October 2023