Minterest and LayerZero: A New Era in Multi-Chain Lending & Borrowing

Enhancing User Experience through Simplified, Secure Cross-Chain Lending.

Minterest is excited to announce its integration with industry-leading omnichain protocol LayerZero to lay a foundation for its recently announced Multi-Chain Strategy!

This strategy is part of Minterest’s long-term roadmap, which will run in 3 distinct phases. The LayerZero integration is part of phase 3: Unifying Liquidity, which will run from Q4 2023 – Q1 2025.

By unlocking a high tier in user experience and tackling cross-chain complexities such as reliance on centralised exchanges and expensive bridging fees, this alliance unlocks a new level of simple, efficient and cost-effective lending and borrowing across multiple blockchains.

It also opens the door for Minterest’s LPs and borrowers to leverage a broader range of DeFi opportunities, as well as the potential for future protocol collaborations, such as cross-chain liquidations through native asset bridge Stargate.

Let’s take a look at how this integration addresses the challenges of multi-chain lending and borrowing and brings new opportunities to the $MINTY community.

The Challenges of Multi-Chain Lending & Borrowing

Navigating DeFi across multiple blockchains without the appropriate infrastructure presents distinct challenges. These could include costly and time-consuming transactions, the unnecessary use of third parties such as centralised exchanges, and the potential for technical mishaps like sending assets to the wrong chain—to name a few.

The Complexities of Multi-Chain Lending

Consider a user who wants to leverage a yield farming opportunity on Polygon using $MATIC tokens while holding $DAI on Ethereum.

Traditional Approach:

- Asset Migration: Swapping $DAI for $MATIC typically involves slippage and exchange fees.

- Bridging and Borrowing: Lending $DAI, borrowing $MATIC, and bridging it to Polygon incurs bridging fees and can be time-consuming (several days in some instances).

- Missed Opportunities: Delays in asset transfers due to the multiple steps involved might result in missed yield opportunities on Polygon.

- Cost vs. Benefit Dilemma: The associated costs can outweigh the gains.

Centralised Exchanges: A DeFi Contradiction

Without access to a direct, decentralised bridge, users often resort to centralised exchanges (CEX) for cross-chain transfers.

This process typically involves transferring assets from a web3 wallet to a CEX and immediately withdrawing those assets to a different chain on the original web3 wallet.

While this approach provides a workaround, it contradicts DeFi’s decentralised nature and introduces several issues:

- Security: Centralised platforms pose potential security threats due to a lack of self-custody.

- Operational Challenges: Multiple steps, such as withdrawals and deposits, complicate the process.

- Fees: Various transactions accrue fees, diminishing profitability.

These challenges underscore the need for a solution that simplifies cross-chain navigation, reduces costs, and enables swift capitalisation on DeFi opportunities.

Minterest Meets LayerZero

Minterest’s LayerZero integration introduces a solution to these challenges, enabling users to leverage opportunities on alternative chains without needing to relocate or convert their assets.

For instance, users can lend assets and earn yields in their native form, avoiding intermediary costs like bridge and swap fees. It also mitigates risks associated with managing multiple wallets and tracking assets across chains.

Real-World Applications

This collaboration is part of phase 3 of Minterest’s multi-chain lending strategy. It extends beyond a technical upgrade, providing tangible benefits and practical applications for everyday DeFi users.

Let’s take a look at an example scenario:

Disclaimer: The following is a hypothetical example for illustrative purposes only. Minterest does not have immediate plans to deploy on Arbitrum.

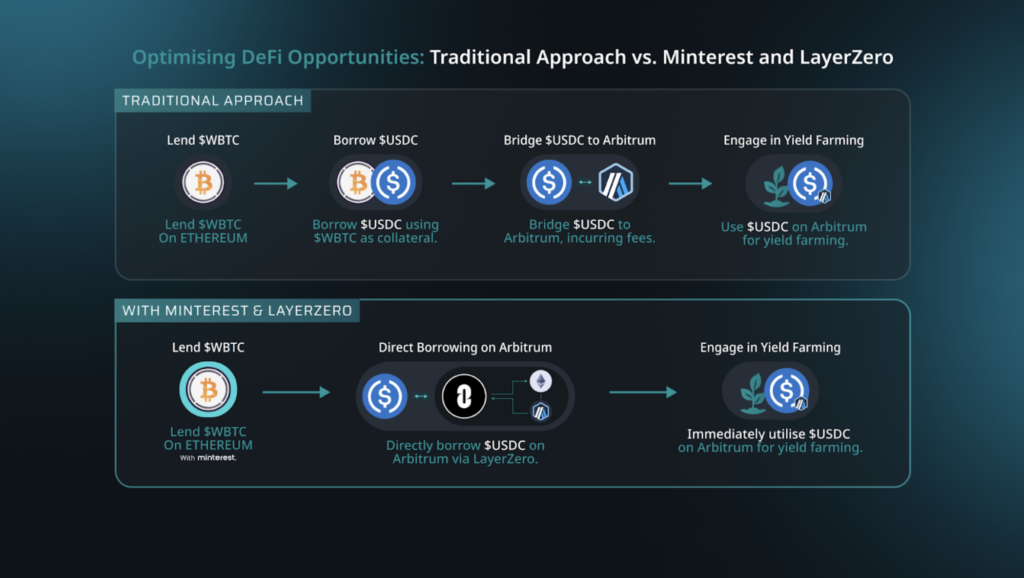

A DeFi user wants to leverage a yield farming opportunity on Arbitrum but is holding $WBTC on Ethereum.

Traditional Approach:

- 1. Lend $WBTC: Lend $WBTC on an Ethereum-based lending protocol to earn interest.

- 2. Borrow $USDC: Borrow $USDC against $WBTC collateral.

- 3. Bridge $USDC to Arbitrum: Use a bridge to transfer $USDC from Ethereum to Arbitrum, incurring bridge fees.

- 4. Engage in Yield Farming: The $USDC can now be used on Arbitrum for yield farming.

With Minterest and LayerZero:

- 1. Lend $WBTC: Lend $WBTC on Minterest on Ethereum.

- 2. Direct Borrowing on Arbitrum: Directly borrow $USDC on Arbitrum via LayerZero, bypassing the need to bridge assets.

- 3. Engage in Yield Farming: Immediately utilise $USDC on Arbitrum.

This integration means that the user can bypass the bridging step, saving on fees and reducing the time and complexity involved in the process. The streamlined approach allows them to quickly and efficiently capitalise on the chain-chain yield farming opportunity.

Exploring Cross-Chain Liquidations

The Minterest team is also exploring the possibilities of integrating with protocols such as Stargate—the first fully composable native asset bridge built on LayerZero.

Stargate supports unified liquidity pools and instant guaranteed finality, which could enhance Minteret’s capabilities by facilitating cross-chain liquidations.

Though this prospect remains in the research stage, liquidations across various chains have the potential to greatly benefit the Minterest ecosystem by ensuring optimal capital utilisation and minimising user liquidation costs.

Summary

Minterest’s LayerZero integration simplifies the intricacies of multi-chain lending and borrowing and addresses common cross-chain challenges, such as high fees due to swaps, slippage and bridging expenses.

This collaboration builds upon Minterest’s user experience and negates the need for multiple platform interactions and complex asset transfers. It also reduces costs by allowing users to bypass traditional bridges and to lend, borrow, and leverage DeFi opportunities across various chains—without needing to relocate or convert their assets.

Minterest is excited about future advancements and partnerships that will continue to elevate the user experience and expand opportunities within the DeFi space.

To learn more about the growing $MINTY ecosystem and how you can get involved, check out some recent articles, follow Minterest on Twitter, and drop by the Telegram or Discord channel for a chat!

31, October 2023