Bridging the Yield Gap: Minterest Integrates with Swing for Enhanced Cross-Chain Lending & Borrowing

As DeFi becomes more widely adopted, new blockchains, Layer-2 scaling solutions, bridges and DEXs are being released at a rapid rate. While this diversity is a net positive for the crypto space, it also brings about new challenges.

How can users move their assets across all these networks and protocols and capitalise on the growing number of opportunities without sacrificing speed, security and cost efficiency?

Traditional methods often involve multiple steps, such as transferring funds across expensive and time-consuming bridges, sending assets between multiple wallets, or using centralised exchanges as a bridging workaround.

To address these challenges, Minterest is excited to announce it will be integrating Swing as part of phase 1 of its Multi-Chain Strategy. During this phase—Single Chain Deployment—users will be able to bridge assets to Ethereum using Swing for use on Minterest. As part of the longer-term roadmap, the integration will be optimised to include a ‘Bridge and Supply’ feature.

This collaboration aims to simplify cross-chain liquidity. With Swing, Minterest can tap into global crypto liquidity, offering users reduced fees, faster transactions, and an intuitive lending and borrowing experience.

Swing & Minterest: Bridging the Divide

Swing aggregates bridges and DEXs to enable seamless asset transfers across blockchains. By integrating Swing, Minterest saves users time and money by bypassing unnecessary transactions and avoiding potential security vulnerabilities that cross-chain lenders and borrowers often face.

In one sentence, Minterest utilises Swing’s advanced features to unlock a little cross-chain magic!

Swing’s Features & Utility:

- Connectivity: Links to over 25 blockchains, offering diverse asset management options.

- Aggregation: By aggregating 60+ bridges and DEXs, Swing provides a one-stop solution for cross-chain transfers.

- Liquidity: Taps into $6 Billion of ready liquidity, optimising transactions for reduced slippage.

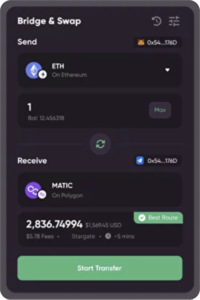

- Plug-and-Play Functionality: Swing’s user-friendly widget allows users to quickly review their positions and carry out cross-chain migrations without the typical bridging complexities.

Swing stands out as a unique aggregator in the DeFi space. Unlike traditional platforms, it gives users the autonomy to choose the bridge they trust the most. Every transaction depends on the user’s chosen setup—the bridge and the assets involved.

Minterest doesn’t directly display, transfer, or store bridged assets. Instead, it leverages the Swing widget’s plug-and-play functionality, acting as an intermediary. This allows users to quickly review their positions and carry out cross-chain migrations with minimal hassle.

This flexibility ensures that users are not confined to a one-size-fits-all solution but have the freedom to tailor their cross-chain activities based on their preferences and risk appetite.

What does this mean for LPs and borrowers?

Minterest’s goal is to ensure that while the technology behind the scenes may be complex, the user experience remains intuitive, cost-effective and secure.

Let’s illustrate by comparing a traditional opportunity to one utilising Swing on Minterest.

Traditional Approach:

A user wants to take advantage of a time-sensitive, high-yield lending opportunity on Minterest’s Ethereum platform but is holding $USDC tokens on the Polygon blockchain.

Traditionally, they would have to navigate multiple steps on an external platform to bridge their $USDC from Polygon to Ethereum. This process often involves several transactions and intermediaries, leading to increased costs and wasted time.

With Minterest and Swing:

Disclaimer: The following is a hypothetical example for illustrative purposes only. Minterest does not have immediate plans to deploy on Polygon.

With Minterest’s Swing Integration, the process is streamlined:

- The user holding $USDC on Polygon identifies the lending opportunity on Minterest’s Ethereum deployment.

- Instead of navigating elsewhere, they open the Swing modal to start the bridging process.

- The modal instantly detects the $USDC holdings on Polygon.

- With a few clicks, Swing facilitates the bridging of $USDC from Polygon to Ethereum.

- The $USDC tokens can now be lent on Ethereum to start earning yield.

The result? A simplified and expanded lending and borrowing experience that allows them to take advantage of cross-chain opportunities with fewer steps, saving both time and costs and the usual hassle.

The Future of Multi-Chain Lending & Borrowing

Minterest is gearing up for a significant shift—the introduction of a multi-chain platform by 2025. Central to this is the integration of Swing, which will allow lenders and borrowers efficient and secure asset transfers and unlock opportunities across 25+ blockchains!

Here’s what Martti Kullang, Chief Product Officer at Minterest had to say about the Swing integration:

“By incorporating this user-friendly bridging tool within the Minterest application, we’ve made it effortless for users to bridge assets to chains supported by Minterest. This tool not only simplifies the user experience but also encourages more users to engage. As a result, this integration contributes to the expansion of our user base and ensures a more accessible and efficient service for our community.”

Users no longer need to grapple with intricate bridging processes. Instead, they can supply assets on Minterest from one chain to another with just a few clicks!

This collaboration not only broadens the scope of opportunities for users but also underscores Minterest’s commitment to diversifying and enhancing DeFi’s lending and borrowing sector.

For more insights into Minterest’s partnerships, development announcements and how you can be a part of the $MINTY community, check out some recent articles, follow Minterest on Twitter, and drop by the Telegram or Discord channel for a chat!

26, October 2023