Adaptable Interest Rates: The Benefits of Minterest’s Dynamic Model

Lending and borrowing platforms have long grappled with the challenge of setting interest rates that are fair and responsive to market dynamics.

Static models — systems where interest rates are set for fixed periods regardless of market changes — fail to reflect real-time supply and demand. This leads to inefficiencies, as rates often don’t match the current market conditions.

To combat these inefficiencies, Minterest utilises a dynamic interest rate model that directly aligns with market activity.

The Problem With Static Models

The static interest rate model employed by some lending and borrowing protocols maintain fixed rates over predetermined periods.

Consequently, borrowers face higher costs during periods of low demand, while lenders miss out on higher returns during times of high demand.

Consider a scenario where the market suddenly shifts — perhaps due to a significant price movement or a global economic event.

Impact on Lenders:

When there’s a surge in borrowing or a sudden market spike, lenders miss out on potential earnings and do not receive returns in line with the increased demand and risk during this period.

Impact on Borrowers:

When the market experiences a downturn, static models fail to reduce interest rates. This results in borrowers paying higher rates than what would be fair in the current market context.

These issues highlight the necessity for systems that can recalibrate interest rates quickly, ensuring synchronisation with the current market supply and demand.

Minterest’s Dynamic Model

At the heart of Minterest’s dynamic lending model is the Utilisation Ratio—a live metric that calculates the percentage of funds currently borrowed compared to the total funds available for lending. This ratio is crucial in determining interest rates, serving as an indicator of market demand and supply.

The foundational logic of Minterest’s rate model draws inspiration from the Compound codebase, a well-established protocol in the DeFi lending and borrowing space. This adoption ensures a tried-and-tested approach to interest rate adjustments.

For a more thorough breakdown of the intricacies of dynamic lending and borrowing, refer to Minterest’s Technical Whitepaper.

The interest rate is dynamically adjusted through an algorithm that responds to lending and borrowing transactions. In active market conditions, Minterest’s interest rates may undergo frequent updates, driven by the volume of lending and borrowing transactions. However, it’s important to note that these updates are not instantaneous and may take some time to be reflected.

When there’s a shift in the market—such as a sudden increase in deposit volume—the Utilisation Ratio decreases, indicating an excess of liquidity. Minterest’s protocol detects this change and automatically lowers interest rates to encourage borrowing.

Conversely, if the market experiences a surge in borrowing, the Utilisation Ratio increases. Minterest’s system reacts by raising the interest rates to attract more liquidity, ensuring lenders are adequately rewarded for their risk during high-demand phases.

Minterest’s dynamic interest rate model and its underlying technology translate into direct benefits for users.

Minterest’s Dynamic Model in Action

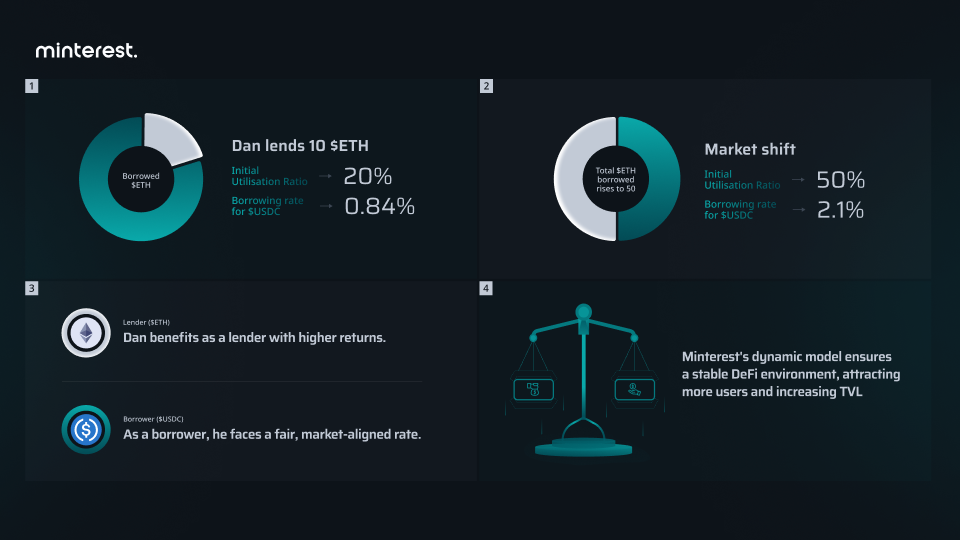

Dan, a user on Minterest, has lent 10 $ETH and is looking to borrow $USDC. Initially, the total $ETH available for lending on the platform is 100, with 20 already borrowed. This sets the Utilisation Ratio at 20%, and the interest rate for borrowing $USDC is 0.84%.

Market Change: A Bullish Report

A bullish market report triggers an increase in borrowing. The total $ETH borrowed jumps to 50, pushing the Utilisation Ratio to 50%. Minterest’s dynamic model responds by adjusting the interest rate for borrowing $USDC to 2.1%.

Impact on Dan: Balancing Lender and Borrower Benefits

As a lender, Dan benefits from the increased interest rates due to the higher borrowing demand, enhancing his returns on the lent $ETH. This responsiveness to market demand ensures that his assets are not only productive but also that his returns are aligned with market conditions.

However, as a borrower of $USDC, he now faces a higher interest rate, reflecting the heightened market activity.

Despite this, the real-time adjustments to interest rates mean that Dan is not subject to static rates that may be out of sync with the market. He can access loans at fair rates that reflect current market liquidity, potentially lowering borrowing costs during periods of high liquidity.

Please Note: This is a hypothetical scenario used for example purposes only.

The balance Minterest maintains between borrower demand and lender supply contributes to a stable DeFi environment. This stability attracts more users, which can lead to an increase in the platform’s TVL, creating a positive feedback loop that benefits all participants.

Wrapping Up

Minterest’s dynamic interest rate model and automated risk management protocols are designed to directly address the needs of borrowers and lenders in the DeFi space. It’s a model that doesn’t just react to the market—it moves with it, ensuring that borrowers and lenders are always engaged in a fair and balanced financial ecosystem.

Borrowers benefit from rates that reflect market liquidity, potentially reducing costs when liquidity is high. Lenders gain from increased returns aligned with market demand, ensuring their assets work effectively for them.

The system’s automated adjustments to collateral and liquidation thresholds help maintain a stable lending environment, mitigating the risks associated with market volatility.

Through these mechanisms, Minterest aims to provide a lending and borrowing platform that is not only efficient and competitive but also secure and user-centric.

To learn more about how Minterest is improving DeFi lending and borrowing, check out some recent articles, follow Minterest on Twitter, and drop by the Telegram or Discord channel for a chat!

16, November 2023